- The Bridge

- Posts

- Investa Farm 👩🏽🌾

Investa Farm 👩🏽🌾

Blockchain for Better Harvests

Bridging the gap between Investors and Ventures

Setting the Scene

Farming is the heartbeat of Africa, but for many farmers, access to reliable financing and quality inputs remains out of reach - leading to limited growth and unpredictable harvests. Here’s a quick look at the key issues they face:

Limited Access to Financing: Most traditional banks view smallholder farmers as high-risk, leaving them without the capital they need to buy quality seeds, equipment, or insurance.

High Costs & Uncertain Outcomes: When funding does become available, it often comes at high rates, with no embedded insurance, leaving farmers vulnerable.

Growing Demand: The demand for food security is soaring, with the African population expected to nearly double by 2050, putting immense pressure on local agriculture.

Why does this happen?

The root of these challenges lies in structural gaps within the agricultural finance sector:

Risky Lending: With volatile markets and unpredictable weather, banks find it challenging to extend loans to farmers without safeguards.

Informal Ecosystems: Farming in Africa is often informal, with minimal access to data and tools to gauge risk, pushing lenders away.

Limited Financial Products: Few institutions offer tailored loan products that include features like embedded insurance, which would protect farmers from unexpected losses.

This week’s company tackles these barriers head-on, offering a digital ecosystem where farmers can access affordable loans, insurance, and high-quality agricultural inputs, all through a blockchain-powered platform.

In a Sentence

Investa Farm is a blockchain-based fintech platform that connects smallholder farmers to quick, insured loans, offering them essential resources and financial security to grow their farms.

Blockchain-Driven Transparency: By leveraging blockchain, Investa Farm ensures that every transaction is traceable, creating trust between farmers and lenders.

Embedded Insurance: Farmers have peace of mind knowing their investments are secure, with insurance that protects their loans and ensures long-term financial stability.

Accessible Financing: Investa Farm’s digital platform makes loan acquisition easy, so farmers can focus on what matters most—growing food for the community.

A “bridge” version:

Investa Farm connects African farmers to fast, secure financing, empowering them to grow their farms sustainably and avoid the costly pitfalls of traditional lending.

The Basics

Industry: AgriTech, FinTech, Blockchain

Headquarters: Nairobi, Kenya; London, United Kingdom

Year Founded: 2024

Employee Count: 11

Notable Partnerships: KCB Bank, Safaricom, Commodities Fund

Fundraising to Date: £115,000 from Startupbootcamp, Adanian Labs, Dfinity, Polygon, Ygap, ALX Ventures

Current Fundraising Goal: £750,000 to scale and enhance platform capabilities

Early Traction: 1,000+ farmers financed, $10,878.00 in total loan value disbursed, $12,000 in revenue in the first 7 months, 20%+ monthly growth in farmers onboarded

Business Model: B2B2C

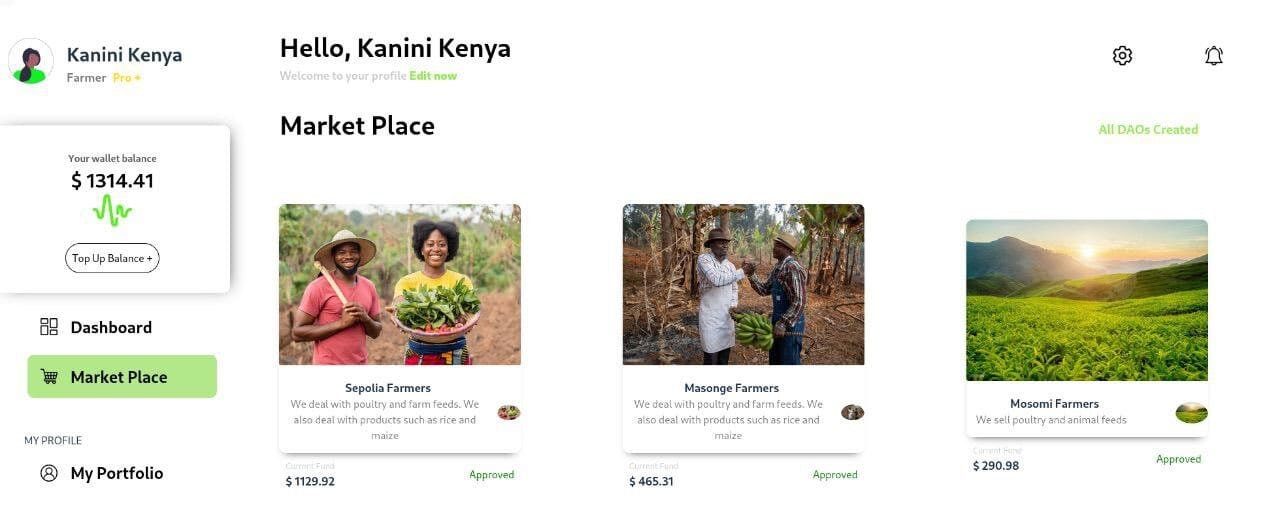

The Investa Farm Platform

Due Diligence

WHAT WE LIKE

🌾 Direct Impact: Investa Farm provides loans to underserved farmers, empowering them to reinvest in their farms and increase productivity.

💡 Market Potential: With an estimated $958 million agri-financing market in Africa, Investa Farm is well-positioned to tap into a rapidly growing sector.

📈 Early Momentum: With over 550 active farmers, 15,000 farmers on the waitlist and notable support from investors like Polygon and Adanian Labs, Investa Farm is showing strong initial traction.

🤝 Strong Partnerships: Investa Farm collaborates with essential industry players, including agronomists, insurers, and stable coin lenders, to deliver value beyond financing.

POTENTIAL RISKS

🌦 Market Volatility: Relying on blockchain could pose challenges in volatile markets, where technology adoption rates are inconsistent. External factors like climate change and market fluctuations, could impact Investa Farm’s loan recovery rates.

⏳ Adoption Curve: Introducing blockchain to rural farming communities may require additional education and support to build trust and usage.

👨🏽⚖️ Regulatory Compliance: Navigating financial regulations across multiple African regions could present legal and operational challenges.

Founder Profile

Moses Liech, Co-Founder & CEO:

Moses brings a deep-rooted passion for agricultural innovation and fintech. His experience with Hesa Africa and the Power Learn Project has equipped him with a unique understanding of Africa’s agri-finance challenges. As an Entrepreneurship Fellow at the Dunin Deshpande Queen’s Innovation Center, Moses combines his vision for growth with a dedication to empowering farmers.

Corrine Muriuki, Co-Founder & CPO:

With a background in agribusiness, agritech, and sustainable development, Corrine is dedicated to improving financial access for farmers in Africa. She brings extensive experience from both the public and private sectors, making her a well-rounded leader who understands the financial and operational nuances of agriculture in emerging markets.

Stephen Kimoi, Co-Founder & CTO

With experience in product management and technology development from companies like Kushites Internet Computer Protocol and AIESEC Kenya, Stephen is an expert in Web3 and building scalable tech platforms. His focus on blockchain ensures Investa Farm is equipped with secure, innovative solutions tailored to farmers’ needs.

To request an introduction to the founders, respond to this email.

Comps

AgroCenta: AgroCenta connects smallholder farmers to buyers and financial services, addressing both market access and financing issues. Their digital platform includes services like real-time pricing, financing, and market linkage, ensuring that farmers receive fair prices and better support.

Farmerline: Farmerline has an international impact and offers digital solutions to farmers globally. The platform provides agronomic advice, inputs, and financial services to smallholder farmers via mobile technology. Farmerline also collects data on crops and weather to improve farmer access to global markets.

AgriDigital: AgriDigital provides blockchain-enabled solutions for supply chain finance in agriculture. They streamline the buying and selling of crops and ensure transparent, secure payments. The platform integrates blockchain for tracking and automating contracts and payments, providing a model example for Investa Farm’s finance and transparency goals.

Why Investa Farm?

A Bridge for African Farmers 🌱

Farmers are the backbone of Africa’s food security, yet they’re often cut off from the resources and financial support needed to reach their full potential.

Investa Farm is not only helping farmers secure affordable loans but also ensuring they have access to quality inputs and embedded insurance for peace of mind.

Through blockchain, they’re building a bridge to a future where farmers have the tools, transparency, and support they need to succeed feeding their communities and beyond.

📢 EVENTS BOARD

Latitude59 Kenya Edition 2024 🇪🇪 🇰🇪

🎉🎉 Big News: We are excited to announce that the second edition of Latitude59 Kenya will take place on November 28, 2024, bringing together innovators, investors, and ecosystem builders from across Africa and Europe to discuss key topics such as startup growth, funding, and market entry strategies.

This November, Latitude59 joins forces with Tech Safari to open doors to East Africa and connect the international tech community. The event will offer an unparalleled opportunity to engage with leading founders, VCs, and policymakers from both continents, focusing on how European-African partnerships can drive tech innovation and investment.

“Latitude59 Kenya Edition 2023 was even bigger and more successful than we dared to hope. And this is just the beginning of our bigger vision of building a Global Village, bringing diverse communities together to make the tech world more human. Working on another continent was a new challenge for our team, but it was an amazing experience, well worth it, and we are so proud of what we put together,”.

- Liisi Org, the CEO of Latitude59.

Invest Wisely with The Daily Upside

In this current market landscape, we all face a common challenge.

Many conventional financial news sources are driven by the pursuit of maximum clicks. Consequently, they resort to disingenuous headlines and fear-based tactics to meet their bottom line.

Luckily, we have The Daily Upside. Created by Wall Street insiders and bankers, this fresh, insightful newsletter delivers valuable market insights that go beyond the headlines. And the best part? It’s completely free.