- The Bridge

- Posts

- Otto 🚗

Otto 🚗

Reinventing Rentals with Digital Infrastructure

Bridging the gap between Investors and Ventures

Setting the Scene

Mobility plays a huge role in economic growth—yet in many African cities, renting or leasing a car is still a patchwork of manual bookings, informal brokers, and opaque contracts. The system hasn’t caught up to the digital era. Here’s why this matters:

Manual Processes: Many rentals are booked via WhatsApp or phone calls, creating friction and fraud risk.

Idle Assets: Vehicle owners struggle with mismatched demand and supply, leading to underutilized fleets.

Fragmented Tools: Rental operators juggle spreadsheets, manual contracts, and third-party services just to manage daily operations.

Why does this happen?

Lack of Digital Infrastructure: The rental sector is underserved by SaaS tools built specifically for African markets.

Trust & Compliance Gaps: With limited KYC, contracts, and insurance digitized, it’s hard to scale trust across the ecosystem.

Financing Bottlenecks: Banks use outdated underwriting methods, offering inflexible capital to asset owners.

This week’s company tackles all of these, layering SaaS infrastructure with a marketplace and—soon—embedded asset financing.

In a Sentence

Otto is building the digital infrastructure for car rental and leasing in emerging markets, starting with a SaaS-first model that digitizes supply, matches demand, and unlocks capital for local operators.

SaaS for Operators: Otto’s software helps rental businesses digitize bookings, payments, contracts, operations, and customer management.

Marketplace: Once verified, suppliers get listed on Otto’s demand channels—including corporate rental customers and distribution partners.

Asset Financing (Coming Soon): Otto is piloting an embedded financing solution based on real-time utilization and demand data, unlocking access to capital for operators.

A “bridge” version:

Otto brings offline car rental businesses online—digitizing supply, streamlining demand, and soon unlocking financing—so African operators can scale safely, profitably, and transparently.

The Basics

Industry: MobilityTech, SaaS, Fintech

Headquarters: Nairobi, Kenya

Year Founded: 2019 (relaunched with current product in 2024)

Employee Count: 7 full-time, 1 part-time

Business Model: SaaS licensing, marketplace commissions, asset financing (in pilot)

Current Fundraising Goal: Seed Round

Revenue: $4,100 MRR

Early Traction: $1.7M in GMV processed, 700+ vehicles, 25+ paying firms, $60/month average SaaS price, 28% MoM revenue growth, 72.2% gross margins

Current Expansion: Starting with Kenya’s $729M rental market, expanding to 10 global markets

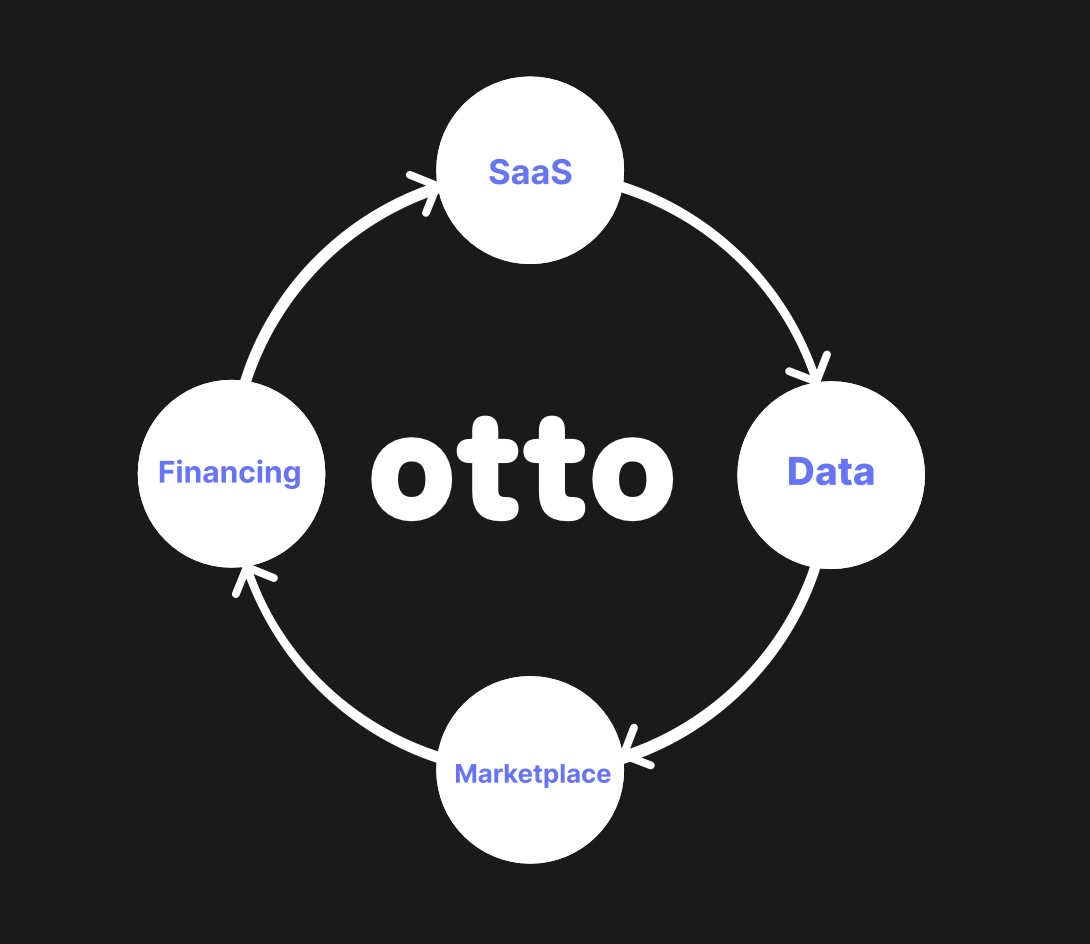

Otto flywheel

Due Diligence

✅ WHAT WE LIKE

🚗 Massive Market Opportunity: Otto is targeting a $56B+ global rental and leasing market—80% of which is asset-financed and largely offline.

📈 Clear Flywheel: By digitizing supply (SaaS), Otto unlocks marketplace demand and builds the data needed for asset financing—creating a defensible moat.

🧠 Experienced Team & Advisors: With second-time founders, ex-McKinsey and M-KOPA leadership, and backing from angel investors and operators in mobility and fintech, Otto’s team brings both domain and execution expertise.

💡 Capital Efficiency: Otto’s traction-to-revenue ratio shows sharp early product-market fit and capital discipline.

⚠️ POTENTIAL RISKS

⏳ Financing Regulation: Asset finance requires compliance with lending regulations, and transitioning into co-lending requires careful partnerships.

🤝 Supplier Onboarding Friction: Some operators may be hesitant to digitize their operations fully without incentives or education.

🌍 Internationalization Complexity: Each new country has its own compliance, payments, and operational frameworks—scaling intelligently will be key.

Reserve a car in 2 minutes or less

Founder Profile

Bradley Opere, Co-Founder & CEO

Former McKinsey consultant and private equity investor with 10+ years in his family’s car rental business. Brad is a Morehead-Cain Scholar and former UNC Student Body President.Devin Hanaway, Co-Founder & CPO

Product designer and former partner at Matter, a product firm that launched 50+ digital products and supported over $60M in funding across five continents.Kelvin Ogwa, Co-Founder & Interim CTO

Full-stack engineer and logistics founder. Previously helped build ParkShare, a European mobility startup, and brings deep experience scaling mobility platforms.

To request an introduction to the founders, respond to this email.

Comps

Moove: Fintech platform offering car ownership and financing for gig drivers

Turo: Peer-to-peer car rental platform with embedded insurance and booking

Zoomcar: Indian car-sharing marketplace digitizing rentals in emerging markets

FlexClub: Vehicle subscription platform in LATAM and Africa

Getaround: Car rental marketplace using IoT and data for bookings and pricing

Why Otto?

A Bridge for Local Operators 🚗

In many emerging markets, the vehicle rental economy is still trapped in the analog world—held back by paperwork, brokers, and lack of financing.

Otto is flipping the script: first by digitizing the backbone of the industry (bookings, contracts, payments), then connecting operators to corporate demand, and finally, helping them grow through financing.

And all of it happens with one tool.

📩 Want an intro to the founders? Just reply to this email.

💥 See the pitch? Ping me.