- The Bridge

- Posts

- Vuna Pay 👨🏽🌾

Vuna Pay 👨🏽🌾

Empowering Farmers with Instant Payments

Bridging the gap between Investors and Ventures

Setting the Scene

Smallholder farmers in Africa are the backbone of the continent’s food supply, yet they face significant barriers when it comes to accessing fair, timely payments for their crops.

Here are a few examples:

Delayed Payments: Farmers wait months to receive payment for their produce.

Low Profit Margins: Many are forced to sell to middlemen at lower prices due to cash flow issues.

Lack of Transparency: Farmers often have no visibility into the payment processes of cooperatives, leading to mistrust and inefficiency.

Why does this happen?

Inefficient Supply Chains: Payments typically pass through multiple hands before reaching the farmer, making it a slow and cumbersome process.

Financing Challenges: Smallholder farmers lack access to formal banking services and immediate financing, which leaves them vulnerable to middlemen offering quick, albeit lower, payments.

This week’s company tackles these financial issues head-on, offering farmers a way to receive instant payments for their produce, boosting their financial security and streamlining the supply chain.

In a Sentence

VunaPay is a fintech platform that empowers smallholder farmers by offering instant payments through cooperatives and financial institutions, eliminating long delays and enabling better financial planning for farmers.

Payment Solutions: Facilitates real-time payments between cooperatives and farmers, ensuring that farmers receive their payments accurately and on time.

Financial Partnerships: VunaPay partners with financial institutions to offer access to credit and other financial products for farmers.

Geomapping: Their latest service helps cooperatives and farmers optimize operations by using geospatial data to improve farm management.

A “bridge” version:

VunaPay connects smallholder farmers to instant payments through cooperatives and financial institutions, ensuring farmers get paid immediately for their produce, empowering them to reinvest in their farms and improve their livelihoods without relying on middlemen or waiting for delayed payments.

The Basics

Industry: AgriTech, FinTech

Headquarters: Nairobi, Kenya

Year Founded: 2023

Notable Partnerships: KCB Bank, Safaricom, Commodities Fund

Fundraising: 54 Collective, Lifetime Ventures

Early Traction: 15,000 farmers on board, with 98,000 more on the waitlist; Ksh 75 million in payments processed, Generating $1,550 in monthly revenue

Business Model: B2B SaaS, Transaction-based revenue for payment facilitation and financial services

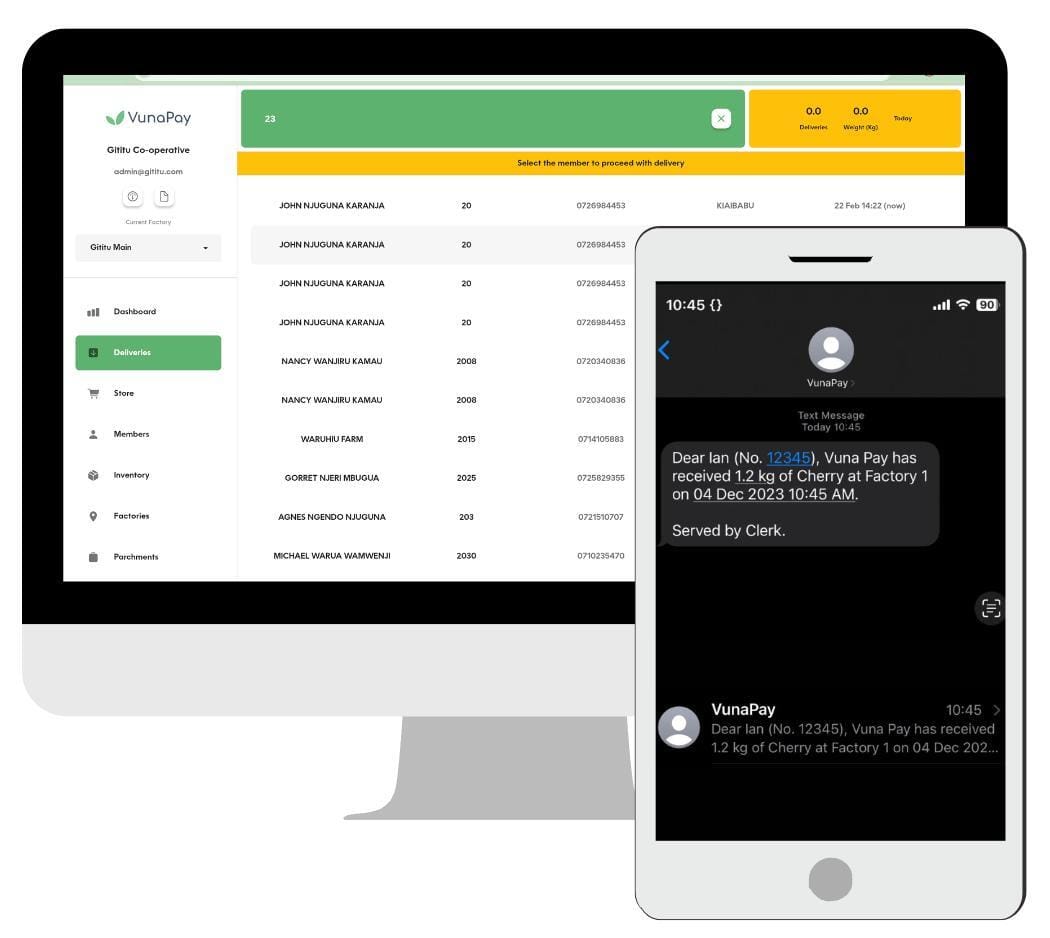

The VunaPay Platform

Due Diligence

WHAT WE LIKE

🌾 Direct Impact: VunaPay directly improves the lives of smallholder farmers by providing them with faster access to funds, reducing their dependency on middlemen.

💡 Market Potential: Africa’s agriculture sector is vast, with millions of farmers who can benefit from instant payment solutions like VunaPay’s.

💻 Strong Partnerships: VunaPay has formed strategic partnerships with financial powerhouses like KCB Bank and Safaricom, which gives it the credibility and infrastructure to scale.

📈 Early Traction: With over 15,000 farmers already using the platform and millions in payments facilitated, VunaPay shows strong early growth and scalability.

POTENTIAL RISKS

⏳ Adoption Challenges: Convincing cooperatives and farmers to adopt a new digital solution may be a hurdle, especially in areas where technology penetration is low.

💰 Cost of Financing: Farmers and cooperatives may find the fees associated with financing challenging, impacting the pace of adoption.

Founder Profile

Judy Njogu, Chief Executive Officer (CEO):

With over 5 years of experience in innovation and product management, Judy brings a wealth of expertise in leading SaaS sales. She has co-founded a startup that generated more than $3M and has deep roots in farming through her family’s agricultural business.

Koya Matsuno, Chief Operating Officer (COO):

Koya has 8+ years of experience in finance and previously served as a product manager at a food tech company. He also founded a crowd-lending platform, showcasing his ability to bridge finance and technology.

Ian Wambai, Chief Technology Officer (CTO):

Ian is an expert in software development with over 10 years of experience. Specializing in AI technology, he has designed and developed 15 mobile applications and has a strong background in product design.

To request an introduction to the founders, respond to this email.

Comps

Emata: Provides digital loans to farmers in Uganda, offering affordable and accessible financial solutions tailored for the agricultural sector.

Apollo Agriculture: Combines financial services with agri-advisory tools for smallholder farmers.

Agrimatic: Focuses on providing financial solutions for farmers in emerging markets.

Why VunaPay?

A Bridge for Smallholder Farmers 👨🏽🌾

Traditionally, farmers have been forced to rely on middlemen for quick payments, losing a portion of their profits in the process.

VunaPay offers an alternative, where farmers are paid instantly and fairly, empowering them to reinvest in their farms, improve livelihoods, and secure their financial future.

Just as bridges connect isolated areas to vital resources, VunaPay connects farmers to the capital they need, ensuring their hard work pays off in real-time.

📢 EVENTS BOARD

Latitude59 Kenya Edition 2024 🇪🇪 🇰🇪

🎉🎉 Big News: We are excited to announce that the second edition of Latitude59 Kenya will take place on November 28, 2024, bringing together innovators, investors, and ecosystem builders from across Africa and Europe to discuss key topics such as startup growth, funding, and market entry strategies.

This November, Latitude59 joins forces with Tech Safari to open doors to East Africa and connect the international tech community. The event will offer an unparalleled opportunity to engage with leading founders, VCs, and policymakers from both continents, focusing on how European-African partnerships can drive tech innovation and investment.

“Latitude59 Kenya Edition 2023 was even bigger and more successful than we dared to hope. And this is just the beginning of our bigger vision of building a Global Village, bringing diverse communities together to make the tech world more human. Working on another continent was a new challenge for our team, but it was an amazing experience, well worth it, and we are so proud of what we put together,”.

- Liisi Org, the CEO of Latitude59.